The 7-Minute Rule for Tulsa Bankruptcy Consultation

Rumored Buzz on Tulsa Ok Bankruptcy Attorney

Table of ContentsWhat Does Tulsa Bankruptcy Consultation Do?Getting My Tulsa Debt Relief Attorney To Work8 Simple Techniques For Bankruptcy Lawyer TulsaChapter 13 Bankruptcy Lawyer Tulsa Things To Know Before You Get ThisUnknown Facts About Bankruptcy Attorney Near Me Tulsa

The statistics for the various other main kind, Chapter 13, are even worse for pro se filers. Suffice it to claim, speak with a legal representative or 2 near you that's experienced with insolvency law.Several attorneys additionally offer free appointments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is without a doubt the ideal option for your situation and whether they believe you'll qualify.

Ads by Cash. We might be made up if you click this advertisement. Ad Currently that you've decided insolvency is without a doubt the appropriate training course of action and you hopefully cleared it with an attorney you'll require to begin on the documentation. Before you study all the official personal bankruptcy types, you must get your own files in order.

Some Known Factual Statements About Affordable Bankruptcy Lawyer Tulsa

Later on down the line, you'll really require to show that by disclosing all type of info concerning your monetary affairs. Below's a fundamental listing of what you'll need on the road in advance: Identifying papers like your driver's certificate and Social Safety card Income tax return (as much as the previous 4 years) Proof of revenue (pay stubs, W-2s, freelance earnings, income from properties along with any kind of earnings from government benefits) Bank declarations and/or retirement account statements Evidence of value of your possessions, such as lorry and realty valuation.

You'll desire to comprehend what type of debt you're attempting to resolve.

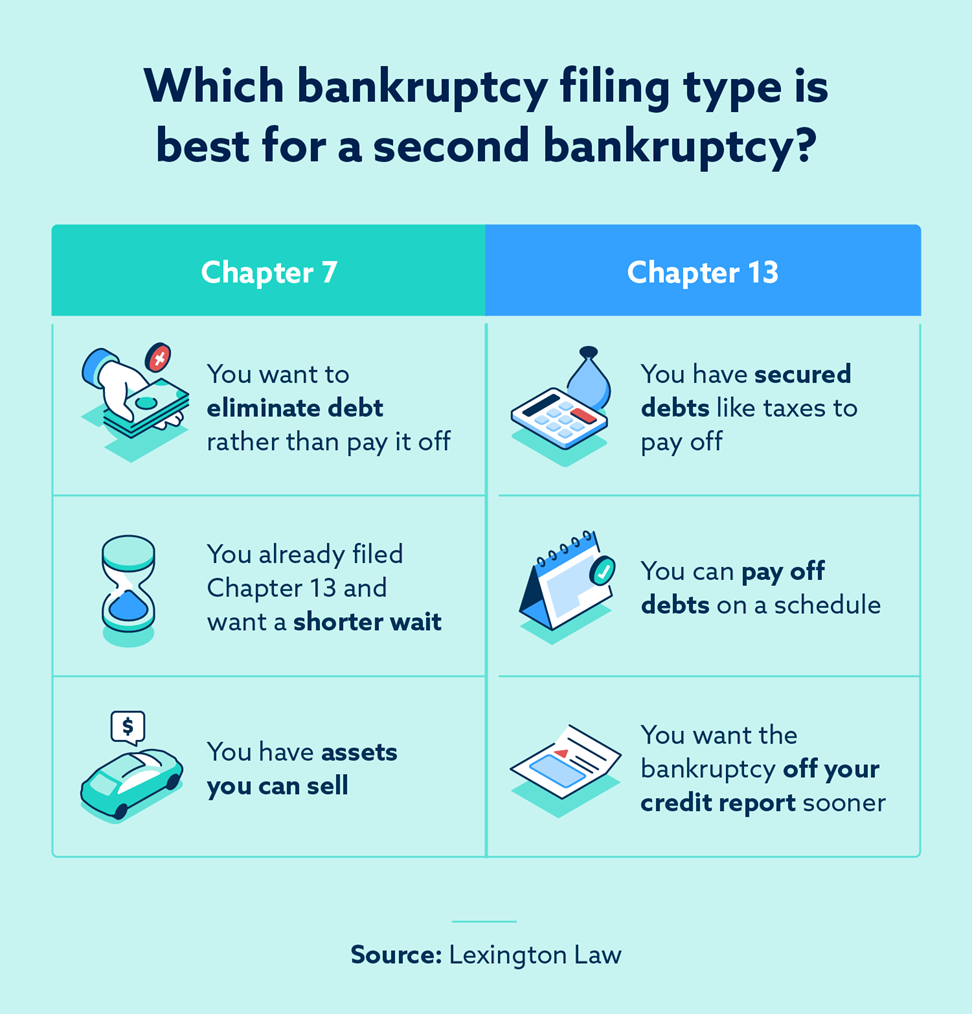

You'll desire to comprehend what type of debt you're attempting to resolve.If your earnings is too expensive, you have another option: Phase 13. This option takes longer to settle your financial debts since it calls for a long-lasting payment plan generally three to 5 years prior to some of your continuing to be financial debts are cleaned away. The declaring procedure is also a great deal more complicated than Phase 7.

See This Report about Bankruptcy Lawyer Tulsa

A Chapter 7 bankruptcy remains on your debt record for one decade, whereas a Chapter 13 bankruptcy falls off after seven. Both have long-term influence on your credit history, and any kind of new financial debt you get will likely feature higher rate of interest. Prior to you send your personal bankruptcy types, you have to first finish an obligatory training course from a credit report therapy company that has been accepted by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, face to face or over the phone. Courses typically set you back in between $15 and $50. You should finish the program within 180 days of declare insolvency (Tulsa bankruptcy attorney). Make use of the Department of Justice's internet site to find a program. If you reside in Alabama or North Carolina, you should pick and finish a training course from a listing of independently authorized companies in your state.

8 Simple Techniques For Tulsa Bankruptcy Attorney

Examine that you're filing with the right one bankruptcy lawyer Tulsa based on where you live. If your long-term residence has actually moved within 180 days of filling up, you must file in the area where you lived the greater section of that 180-day duration.

Typically, your personal bankruptcy attorney will work with the trustee, but you may need to send the person files such as pay stubs, tax obligation returns, and bank account and debt card declarations directly. A typical mistaken belief with bankruptcy is that once you file, you can quit paying your financial debts. While personal bankruptcy can help you clean out numerous of your unsecured financial debts, such as past due medical costs or personal lendings, you'll want to maintain paying your month-to-month settlements for secured financial obligations if you want to keep the building.

The Main Principles Of Bankruptcy Attorney Tulsa

If you're at danger of repossession and have tired all other financial-relief choices, then applying for Chapter 13 may postpone the repossession and assistance save your home. Ultimately, you will certainly still need the earnings to proceed making future mortgage settlements, along with repaying any type of late settlements over the course of your layaway important source plan.

If so, you might be required to give additional information. The audit might delay any type of debt relief by a number of weeks. Naturally, if the audit shows up incorrect details, your instance could be disregarded. All that claimed, these are relatively rare circumstances. That you made it this far at the same time is a suitable indication at the very least a few of your debts are qualified for discharge.